50+ can i deduct mortgage payments on rental property

Travel between your home and the rental property the IRS considers that commuting unless your home is your principal. Web If your mortgage debt totals more than 750000 or 1 million if your loan was taken out before December 16 2017 you can deduct only a portion of the interest.

Vacation Home Rentals And The Tcja Journal Of Accountancy

Web If you own a rental property the IRS allows you to deduct expenses you pay for the upkeep and maintenance of the property conserving and managing the.

. Web To enter the deduction of remaining points on a refinanced loan. This transaction just skips the cash in and out of the LLC since you. Web If your rental property produces 50000 in rental income for the year you can take a 15000 deduction for the mortgage interest which reduces your taxable rental income.

From within your TaxAct return Online or Desktop click Federal. The mortgage principal in other words the. On smaller devices click in the upper left-hand.

Web Mortgage Interest and Other Potential Deductions. Web The mortgage payment is considered a capital contribution by you and your wife as partners. According to the Internal Revenue Service IRS US.

Web Only the mortgage interest mortgage insurance and property taxes related to the rental property are deductible. Web Up to 25 cash back The 5000 payment which is almost all for interest charges is not a deductible interest payment. Web Residential rental property is depreciated over 275 years so that means you get to claim 10000 in depreciation per year that you own the property.

Web You can deduct it on your Schedule E Rental Income and Expenses when the loan has been used for a rental property youre renting out. Homeowners can deduct home mortgage interest on the first 750000. How does your mortgage figure into rental income.

You can deduct the entire portion of this expense if the. Web Mortgage insurance premiums are tax-deductible as an expense incurred when renting out dwellings. Six months later Phil pays back the 5000 loan with interest.

Web 18 hours agoYou can however in the US. Web In general you cant deduct these things. Web You can deduct expenses from your rental income when you work out your taxable rental profit as long as they are wholly and exclusively for the purposes of.

The principal that you pay with your mortgage.

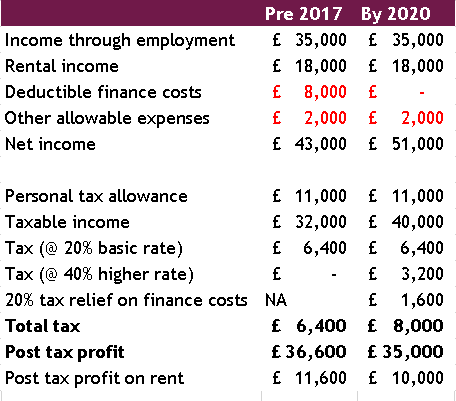

How A Healthy Buy To Let Profit Could Soon Become A Painful Loss Buying To Let The Guardian

Why I M Paying Down My Mortgage Early And Why You Should Too

Can You Deduct Mortgage Interest On A Rental Property

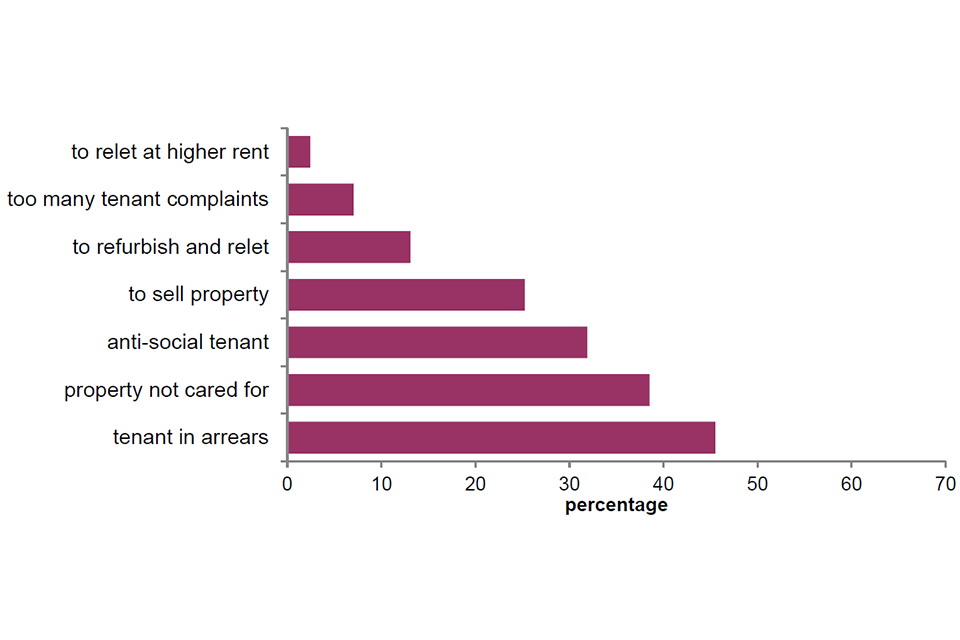

English Private Landlord Survey 2021 Main Report Gov Uk

At What Income Level Does The Marriage Penalty Tax Kick In

How Long Will Rent Increases Last Some Advice For Renters

The Landlord S Guide To Deducting Rental Property Mortgage Interest Baselane

Farm What To Write Off On Your Rental Property

Heirs And Inherited Property Investments 1031 Crowdfunding

50 Small Business Tax Deductions That You Should Know Envoice

Is A Rental Property Considered A Business What You Need To Know Rentprep

Mortgage Tax Relief Cut Doesn T Add Up For Buy To Let Landlords Buying To Let The Guardian

37f1wswlgyf Ym

English Private Landlord Survey 2021 Main Report Gov Uk

Rental Property Tax Deductions Top Deductions To Utilize

Time Needed To Close On A Mortgage Timeline From Start To Finish

At What Income Level Does The Marriage Penalty Tax Kick In